As Germany’s DAX index surged 4.03% recently, buoyed by hopes for interest rate cuts and China’s stimulus measures, the broader European market sentiment appears cautiously optimistic despite signs of slowing business activity. In this environment, identifying stocks with strong fundamentals becomes crucial as they may offer resilience and potential growth opportunities amid economic uncertainties. When evaluating such stocks, investors often look for robust financial health, consistent earnings performance, and strategic positioning within their industries—factors that can help navigate both favorable and challenging market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

|

Name |

Debt To Equity |

Revenue Growth |

Earnings Growth |

Health Rating |

|---|---|---|---|---|

|

Mineralbrunnen Überkingen-Teinach GmbH KGaA |

19.91% |

0.96% |

-5.02% |

★★★★★★ |

|

Westag |

NA |

-1.56% |

-21.68% |

★★★★★★ |

|

FRoSTA |

8.18% |

4.36% |

16.00% |

★★★★★★ |

|

Mühlbauer Holding |

NA |

10.49% |

-12.73% |

★★★★★★ |

|

Paul Hartmann |

26.29% |

1.12% |

-17.65% |

★★★★★☆ |

|

Südwestdeutsche Salzwerke |

0.30% |

4.57% |

25.01% |

★★★★★☆ |

|

HOMAG Group |

NA |

-31.14% |

23.43% |

★★★★★☆ |

|

EnviTec Biogas |

48.48% |

20.85% |

46.34% |

★★★★★☆ |

|

Baader Bank |

91.28% |

12.42% |

-8.00% |

★★★★★☆ |

|

Wilson |

64.79% |

30.09% |

68.29% |

★★★★☆☆ |

Click here to see the full list of 57 stocks from our German Undiscovered Gems With Strong Fundamentals screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Value Rating: ★★★★★☆

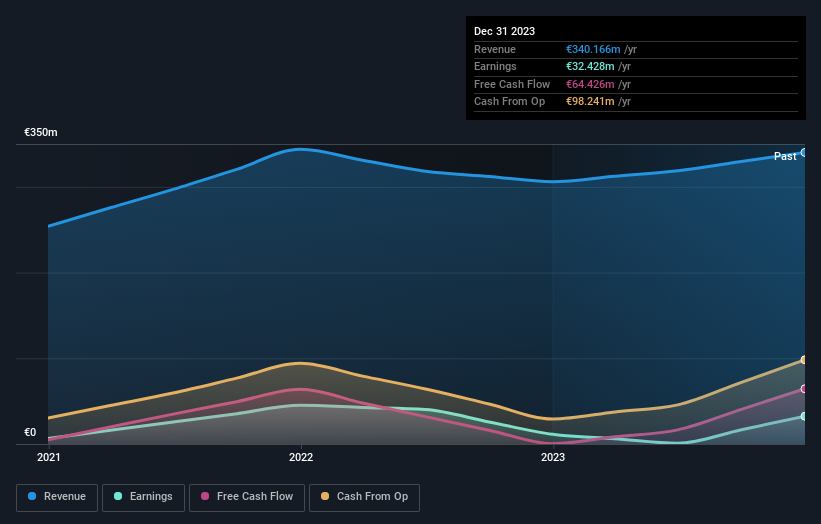

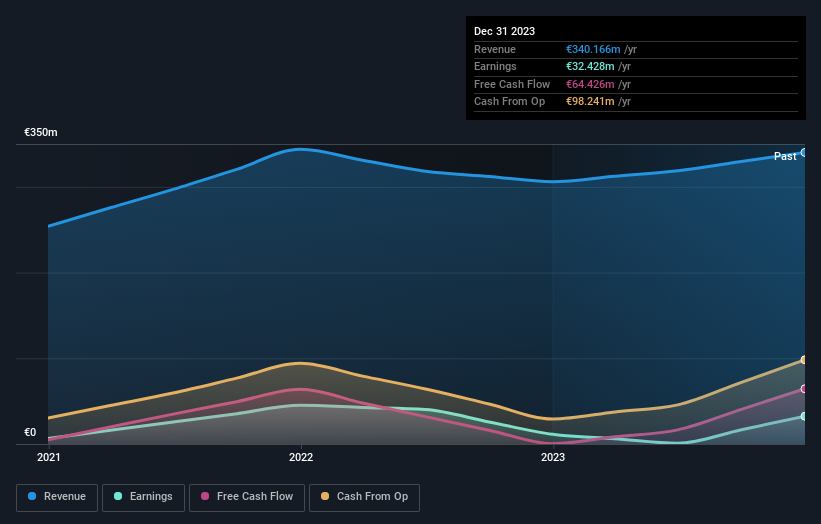

Overview: Südwestdeutsche Salzwerke AG, along with its subsidiaries, engages in the mining, production, and sale of salt across Germany, the European Union, and internationally; it has a market capitalization of approximately €693.50 million.

Operations: The company’s primary revenue stream is derived from its salt segment, generating €283.67 million, while its waste management segment contributes €62.46 million.

Südwestdeutsche Salzwerke, a relatively smaller player, has shown impressive growth with earnings surging by 4290.9% over the past year, far outpacing the Food industry average of 26.8%. The company reported half-year sales of €163.06 million and net income nearly doubled to €15.4 million compared to last year. Trading at 88.9% below its estimated fair value suggests potential for upside, though recent share price volatility might be a consideration for investors.

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE manufactures and sells isotope technology components worldwide, with a market capitalization of approximately €955.97 million.

Operations: Eckert & Ziegler generates revenue primarily from its Medical and Isotopes Products segments, amounting to €132.80 million and €150.97 million respectively. The company faces a segment elimination of €10.32 million, impacting overall revenue figures.

Eckert & Ziegler, a notable player in the medical equipment sector, has shown impressive financial performance. Recent earnings reveal sales of €77.76 million for Q2 2024, up from €60.03 million the previous year, with net income rising to €9.54 million from €6.17 million. The company boasts a debt-to-equity ratio reduction from 14.7% to 9.5% over five years and an EBIT covering interest payments by 20 times, indicating robust financial health and growth potential within its industry context.

Simply Wall St Value Rating: ★★★★★★

Overview: KSB SE & Co. KGaA, along with its subsidiaries, is a global manufacturer and supplier of pumps, valves, and related services with a market capitalization of approximately €1.09 billion.

Operations: KSB SE & Co. KGaA generates revenue primarily from three segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million).

KSB SE KGaA, a notable player in the machinery sector, has shown impressive earnings growth of 16.8% over the past year, outpacing its industry peers who saw a 4% decline. Despite a one-off loss of €102.5 million affecting recent financials, KSB’s debt-to-equity ratio improved significantly from 9.2% to 0.8% over five years, showcasing financial discipline. Trading at about 77% below estimated fair value and maintaining positive free cash flow further highlights its potential as an undervalued opportunity in the market.

Turning Ideas Into Actions

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DB:SSH XTRA:EUZ and XTRA:KSB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com