In the wake of the National Association of REALTORS®’ (NAR) recent decision to stand by the Clear Cooperation Policy, which also added an (ostensibly) new avenue to protect the privacy of listings, brokers are reporting that for the most part, they don’t see a significant need for more “flexibility” in their markets.

Respondents to RISMedia’s latest Broker Confidence Index (BCI), conducted in the days following the NAR announcement, said there just isn’t that much demand for private listings—and also that issues with current rules aren’t about a lack of options.

A huge majority of brokers (81%) said requests by sellers to limit the exposure of their listing—for privacy, as a marketing strategy or for any other reason—were rare, with 61% saying such requests are “very rare.”

While that is likely not surprising, as even the most passionate advocates for private listing flexibility acknowledge that most sellers seek maximum exposure, RISMedia also asked if the current rules (before the implementation of the new NAR exemption) effectively serve the needs of both sellers and agents.

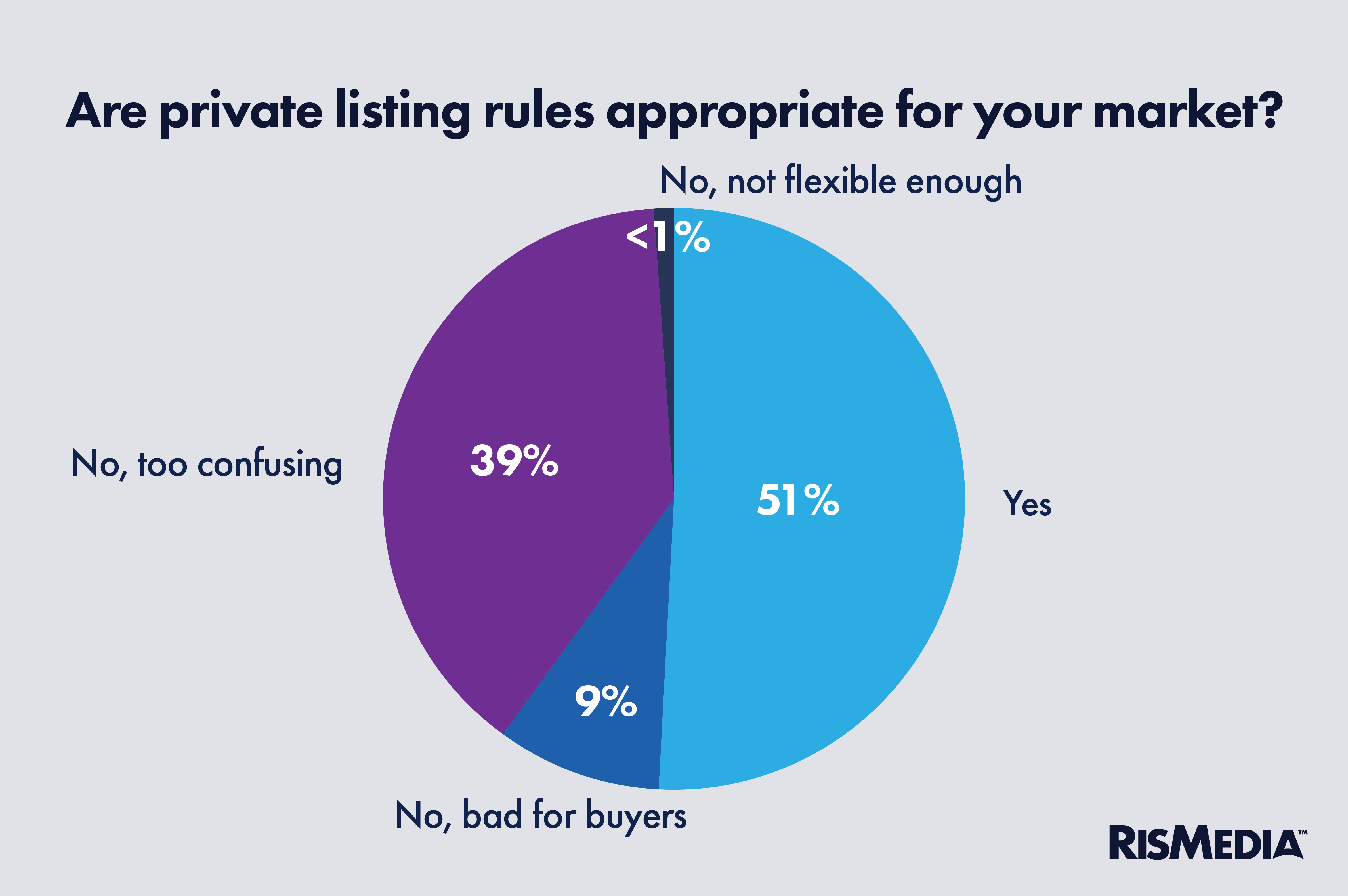

A slim majority (51%) said rules “largely” match the needs of their market, with an additional 9% saying the rules are “overly permissive” and limit buyers’ access to homes.

But notably, most of the remaining 40% described current rules and options as vague, confusing and often misunderstood by real estate professionals—something the new NAR policy is unlikely to address, as it offers more options rather than less and allows individual MLSs to separately dictate key aspects of the “exempt” listing option.

Through the Clear Cooperation controversy, some brokers and real estate business leaders have argued that a lack of flexibility for keeping listings private is harming sellers, who they claim want more options either to keep their information private, or to test out alternative marketing strategies. The response from brokers surveyed by RISMedia indicates that in most markets, there isn’t a significant demand for these kinds of options—either from agents or sellers.

NAR has touted the new “exempt” option as adding flexibility for sellers, allowing them to keep listings from being syndicated (at least partially), though each MLS will decide how to treat “exempt” listings in terms of data tracking and several other restrictions or designations.

One of those restrictions is how long a listing can be “exempt” before it must be syndicated, which NAR previously clarified is entirely up to the local MLS, with any time period allowed.

Asked by RISMedia what they thought was appropriate for that restriction, most brokers (59%) said that one week or less was an appropriate time period. Only 10% of brokers thought listings should be exempted indefinitely, while 21% looked somewhere in between (between one week and two months).

The deadline for MLSs to implement the new policy is just under six months from now, on September 30.

Confidence rises

After a slow start to the year, overall broker confidence bounced back to exactly where it was at this time in 2024, jumping from 6.5 in February to 7 in March.

Brokers reported strong demand, with continued lack of inventory still a bottleneck on the market. More than a few also mentioned issues with real estate rules and policies also weighing on their confidence.

“Too much uncertainty in how to practice as well as still historically low listing inventory,” said Darren Kittleson, broker/owner of multiple Keller Williams’ market centers in Wisconsin.

“Lots of inventory coming on the market, but still not enough,” said Scott Myers, broker/owner of CENTURY 21 Scott Myers REALTORS® in Texas. “Agents not being aggressive enough in trying to get buyers off the dime.”

Over the past few months, consumer confidence has fallen sharply, with worries about trade policy, the job market and inflation all on the rise. The survey was conducted before the latest round of tariffs, announced last Thursday.

While economists have warned that housing won’t escape the impact of policies like tariffs, the increase in sentiment from brokers could be reflective of anticipated regulatory reforms and tax cuts promised by the Trump administration.

Around a third (31%) of brokers mentioned high demand as increasing their confidence, while slightly fewer (20%) mentioned economic policies or uncertainty as decreasing their confidence.

“There is still a lack of inventory, but we are seeing buyers not as frantic to jump in,” said one broker, who requested anonymity. “They are holding back for a variety of reasons: chaos in D.C., and still higher-than-exciting interest rates.”