Skift Take

An uncomfortable truth is emerging in the aftermath of two hurricanes making devastating sweeps through Florida. Natural disasters can be good for business at regional hotels that escape damage.

While hurricanes bring short-term devastation, they often boost medium-term hotel performance in affected regions. Analysts at investment banks Bernstein, Baird, and Truist expect hurricanes Milton and Helene to impact hotel occupancy and revenue in Florida for months.

“Although no company would want to profit from a tragedy, the truth is that hurricanes are largely positive for hotel groups, as the benefit from rehousing evacuated/displaced residents tends to outweigh the loss of business to affected areas,” said Richard Clarke of Bernstein.

By the Numbers:

- Analysts predict that major hotel chains will see a 50-70 basis point boost in their revenue per available room during the last three months of the year.

- The effects could persist into the first half of 2025, adding about 20 basis points to revenue per available room growth.

Not All Hotels Benefit Equally

- Select-service and economy hotels tend to see the biggest gains from displaced residents and relief workers.

- Full-service and resort properties often lose business from cancellations.

- “Nearby cities not in the direct path of the storm usually experience a short-term benefit as residents evacuate,” wrote Michael Bellisario and Daniel Hogan at Baird.

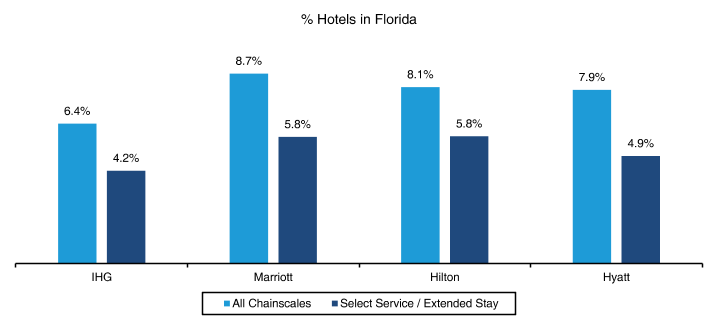

Which Hotel Companies Stand to Gain the Most?

- Marriott has the largest exposure in Florida, with 9% of its U.S. hotels in the state, said Bernstein’s report. Hilton has 6% exposure.

- Choice Hotels and Wyndham could see outsized benefits because they focus on midscale and economy segments, Truist noted.

- Host Hotels & Resorts and other real-estate investment trusts may face higher property insurance costs but could see short-term occupancy boosts, Baird wrote.

What They’re Saying

- “Hotels in affected areas, to the extent they do not sustain damage that significantly impacts operations, should experience a RevPAR [revenue per available room] benefit from Federal Emergency Management Agency â and insurance-related business over the coming weeks and months,” the Baird analysts noted.

- “For example, Hurricane Beryl made landfall in Texas on July 8 and hit Houston as a tropical storm that same day,” the Baird analysts wrote. “Since then, Houston has been the top-performing RevPAR growth market every month (+37% in July, +44% in August, and +13% in September.”

- “On the other hand, hurricane damage will not be a positive for the direction of property insurance rates long-term,” said C. Patrick Scholes and Gregory Miller at Truist.

Accommodations Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of hotels and short-term rental sector stocks within the ST200. The index includes companies publicly traded across global markets, including international and regional hotel brands, hotel REITs, hotel management companies, alternative accommodations, and timeshares.

The Skift Travel 200 (ST200)Â combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more hotels and short-term rental financial sector performance.

Read the full methodology behind the Skift Travel 200.