Skift Take

Destinations are responding to the demands of Indian tourists, making Indian food and services a common sight in global travel hotspots.

On my recent trip to Hanoi, walking through the narrow streets of the Old Quarter, I had no trouble finding comfort food: Indian restaurants were thriving in almost every lane. It was a stark contrast to my visit in 2019, when I struggled to find any.

It makes perfect sense: In 2023, Vietnam brought in 392,000 Indian visitors, a 231% increase from 2019, according to the Vietnam National Authority of Tourism (VNAT). In just the first half of this year, Indian tourist numbers grew by 164%. This isnât just happening in Vietnam â other nations are similarly responding to the demands of Indian tourists, making Indian food and services a common sight in global travel hotspots.

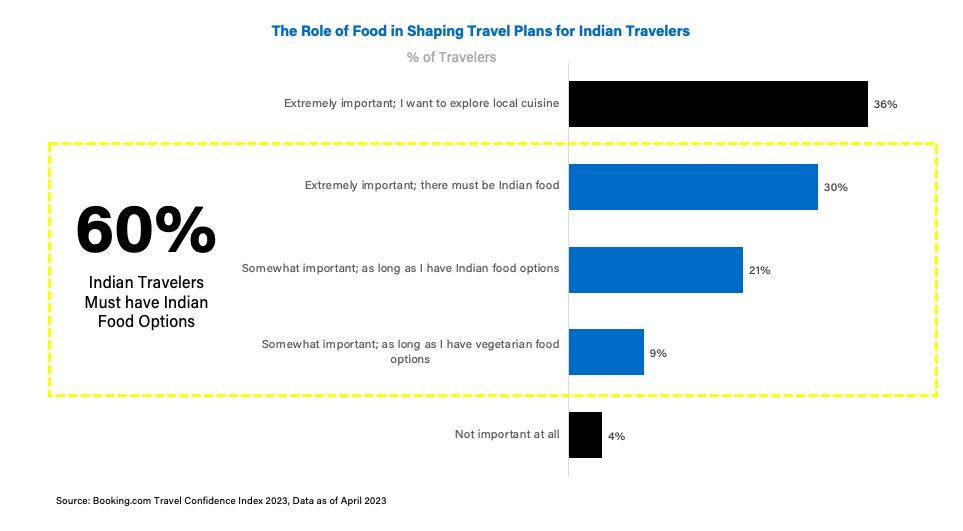

According to Booking.comâs Travel Confidence Index 2023, over half of Indian travelers consider it crucial to have access to Indian food.

Dubai is a prime example of this trend. Indians make up the largest group of international tourists in the city, with over 11.9 million visiting in 2023, according to the Dubai Department of Economy and Tourism.

Indian restaurants are now a staple in Dubai and Abu Dhabi, which cater to the large Indian expatriate community as well as tourists. In fact, Michelin-star Indian restaurants such as Tresind Studio have elevated the standard of Indian cuisine in the UAE.

In the U.S., as we recently reported, Louisiana’s tourism strategy is evolving to attract Indian travelers, focusing on three key areas: food, family travel, and cultural experiences. Recognizing that cuisine serves as an “international language,” the state plans to launch a food-centric campaign next year.

A 2023 report by the National Restaurant Association highlighted a 25% growth in Indian restaurants globally over the past five years, surpassing the overall restaurant industry growth rate.

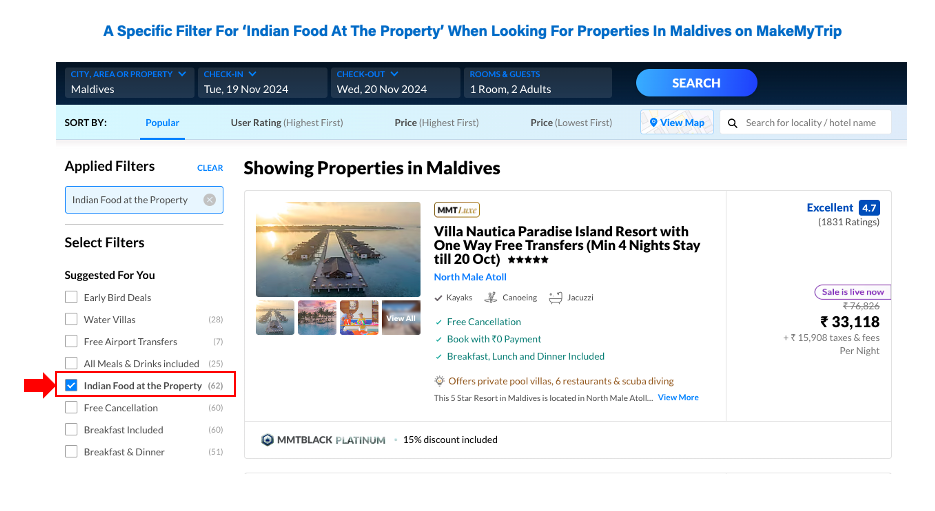

Indian food is even a consideration when booking accommodations. When Indian travelers search for resorts in the Maldives, they often rely on filters like “Indian food available” on platforms like MakeMyTrip.

Adapting Beyond Food

Countries are also adapting to Indian travelers in ways that go beyond food. Language support, culturally familiar services, and religious tourism have all become increasingly important.

For example, Dubai offers Hindi-speaking guides at key attractions like the Burj Khalifa and the Dubai Mall, while hotels and tourism services provide brochures and signage in Hindi to make Indian visitors feel more at ease.

Religious tourism is another growing trend. Bali, with its famous Hindu temples, has seen an influx of Indian tourists seeking pilgrimage experiences. Temples like Pura Luhur Uluwatu now offer specialized Hindu tours and prayer ceremonies designed for Indian visitors.

Malaysia has capitalized on this trend working with Indian travel agencies to promote religious tourism packages to Hindu temples, such as Batu Caves.

Understanding Indiaâs Travel Preferences: Insights for Suppliers and DMOs

Indians arenât just traveling more â theyâre becoming significant spenders in the global tourism industry. A joint report by Booking.com and McKinsey projects that Indians could become the fourth-largest global travel spenders by 2030, as reported by Skift.

The rise of Indian outbound tourism offers significant opportunities for travel suppliers and destination marketing organizations (DMOs). A 2023 Skift Research report titled India on the Move sheds light on the key motivations and preferences of Indian travelers.

One of the most significant findings is that discounting strategies are an effective driver for travel bookings â 88% of Indian travelers booked or planned to book a trip in the next 12 months due to attractive discounts. This highlights the importance of price sensitivity for this demographic.

Indian travelers are also enthusiastic about attending international sports events, despite higher travel costs during such occasions. Over 90% of surveyed Indian travelers acknowledged the high costs but remained interested in attending. Travel suppliers can create premium sports packages, including tickets, transportation, and unique experiences, to appeal to this market.

For DMOs, understanding the needs of Indian travelers can drive success. The survey found that 45% of Indian tourists prefer fully organized package tours, so DMOs should emphasize convenience and ease when marketing their destinations. Highlighting comprehensive packages that cover transportation, accommodation, and sightseeing can attract more Indian visitors, as these tours offer the added advantage of saving time and effort.