Skift Take

This bold move by a Japanese budget carrier will see it compete directly with two formidable big-name competitors. With no transit partners for smooth onward connections, will low fares be enough to fill the planes profitably?

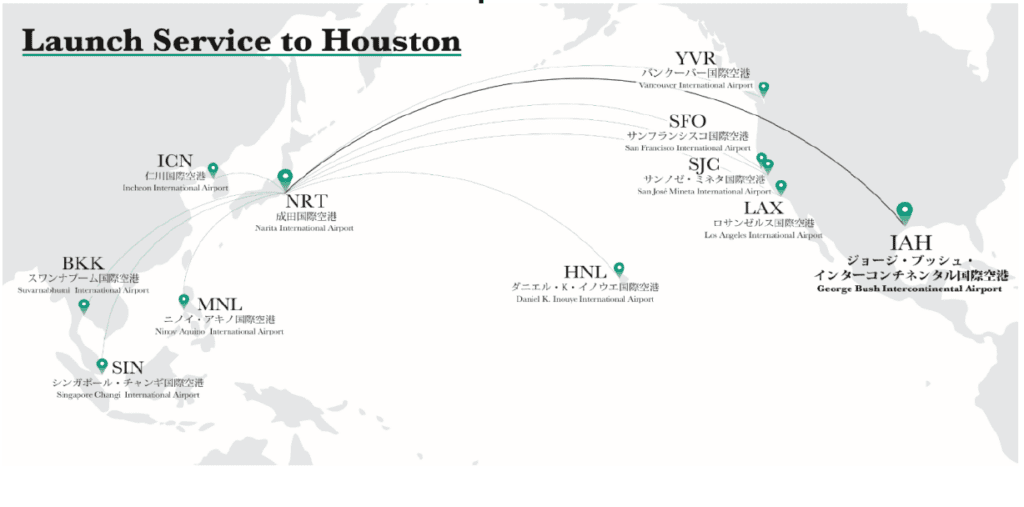

Non-stop travel options between Texas and Tokyo are about to get interesting. On Thursday, low-cost carrier ZIPAIR Tokyo announced a major new route linking Houston with the Japanese capital.Â

From March 4, its nonstop service will connect Houstonâs George Bush Intercontinental with Tokyo Narita. It represents ZIPAIRâs fifth transpacific destination after Los Angeles, San Francisco, San Jose, and Vancouver. The airline also serves Honolulu in Hawaii as well as several Asian cities.

Despite being a budget subsidiary of national carrier Japan Airlines, the brand remains relatively unknown in the U.S. market. ZIPAIR was due to launch ahead of the Tokyo 2020 Olympics, however the pandemic severely disrupted its rollout. The company is now making up for lost time and expanding strongly in Asia and North America.

Services will operate from Houston four times weekly on Tuesdays, Thursdays, Saturdays, and Sundays using Boeing 787-8 Dreamliners sourced from Japan Airlines.Â

Why is ZIPAIR Flying to Texas?

In a statement, ZIPAIR highlighted Texas as becoming âmore business-friendly in terms of tax and costâ in recent years, with a booming population fuelling demand for flights. The carrier also flagged that more than 50 Fortune 500 companies are headquartered in the state.

However, the newcomer wonât have the Houston market to itself. The Texan city already has well-established links to Tokyo with two major carriers. United Airlines flies daily to Narita using the 787-9 Dreamliner. Japanâs All Nippon Airways also operates a daily service to Tokyoâs downtown Haneda Airport using the slightly smaller 787-8 aircraft.

To capture interest and fill seats, ZIPAIR is offering promotional fares from Houston to Tokyo for just $333 one-way. Regular fares will be around $450 each way.

As well as catering to point-to-point traffic, the airline also noted Houstonâs âextensive network of domestic flights within the U.S. and to Central and South America,â adding that âconnections to domestic and international destinations are very convenient.â

In practice, ZIPAIR passengers transiting in Houston will face several hurdles. Although Japan Airlines is part of the powerful oneworld alliance, ZIPAIR does not benefit from any of its parent companyâs partnerships for easy connections.Â

As the airlineâs FAQ page notes: âYou cannot transfer between ZIPAIR and other airlines. You will need to go through the immigration procedures set by each country at the transit airport, so please be sure to check the necessary travel documents for your entry at the embassy.â Any hold luggage will also need to be collected and checked in again.

What is ZIPAIRâs Strategy?

Unlike its better-known parent company, ZIPAIRâs business model requires passengers to buy extras on an a la carte basis. Even inflight meals come at an extra charge for its most stripped-back fares.

That said, it isnât an all-economy operator. ZIPAIR also provides a business class option with lie-flat beds and some of the other trimmings of a full-service airline.

ZIPAIR has many hallmarks of the traditional low-cost model, but it doesnât see itself that way. As company president Shingo Nishida notes: âOur mission is to be the âNew Basicâ airline that defines a new standard that is neither a full-service carrier nor a low-cost carrier. New Basic is not just about controlling costs but incorporating the aesthetic details typified by Japanese airlines and creating a new airline that shortens the sense of time.â

Japanâs Soaring Visitor Numbers

ZIPAIRâs move comes amid an inbound tourism boom to Japan. A record 35 million foreign visitors are expected this year with tourism spending projected to hit JPY 8 trillion ($51 billion).

If realized, the figures will beat the 31.88 million visitors in 2019. The Japanese government has ambitious plans to attract 60 million visitors annually by the end of the decade, with spending expected to soar to JPY 15 trillion ($96 billion).

However, the influx of tourists has brought its own set of challenges, with âovertourismâ concerns at some of the countryâs top attractions.

Airlines Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of airline sector stocks within the ST200. The index includes companies publicly traded across global markets including network carriers, low-cost carriers, and other related companies.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more airlines sector financial performance.

Read the full methodology behind the Skift Travel 200.