Skift Take

Slow growth and not much merger and acquisition activity. Welcome to online travel’s not “terribly exciting” period, according to BTIG.

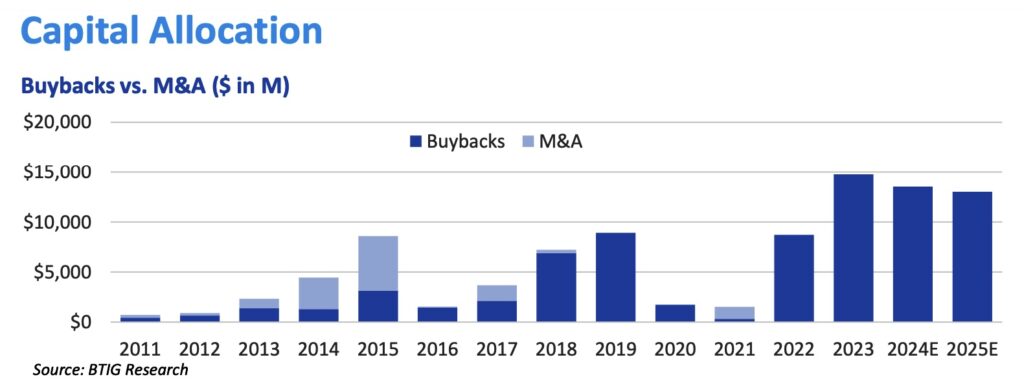

Anyone remember that blockbuster year in online travel, namely 2015, when Expedia acquired HomeAway (Vrbo), Travelocity and Orbitz Worldwide for nearly $5.7 billion?

Those days of frenetic mergers and acquisitions activity among leading online travel agencies have given way in recent years to an era when these companies use capital mostly for stock buybacks, with M&A deals becoming less frequent or consequential, according to a BTIG research report.

And when it comes to next year’s growth prospects, the report forecasts 8% bookings growth combined for Airbnb, Booking Holdings and Expedia.

“The OTAs (online travel agencies) are now growing comparably to the hotel chains,” the report found. “That sort of growth may not be terribly exciting, but it should be enough to drive mid-teens EPS (earnings per share) growth.”

BTIG estmated that Airbnb, Booking Holdings and Expedia Group will generate $15-$16 billion in free cash flow in 2025, allotting around $13 billion of that to stock buybacks.

“Moving forward, we donât expect large-scale M&A given concentration in the space,” the report says.

Of course, even if the online travel industry wasn’t as consolidated as it already is, the regulatory environment in the U.S. and Europe is not particularly friendly turf for big-time mergers. Witness Booking Holdings’ failed attempt to acquire eTraveli Group.

In 2018 and 2019, Expedia and Booking tilted toward stock buybacks worth $15.8 billion while combined they spent just $335 million on M&A during that period, the report found. From 2020-2022, that duo plus Airbnb did $10.8 billion in stock buybacks and merely $1.2 billion in acquisitions.

Modest Bookings Acceleration

The report estimated that online travel agency bookings will grow 6 percent in 2024 and bump up to 8% in 2025. While growth in the U.S. is slowing, it is merely around 30% of global bookings, and the online travel agencies’ international businesses are growing in the low double digits, the report found. Also contributing to 2025 growth would be a foreign currency tailwind of 2 points in Europe next year versus a 1 point tailwind in 2024.

For example, Amsterdam-based Booking.com is pushing into the U.S., Expedia is targeting the Nordics and Japan, and Airbnb has a wide range of international targets from Germany to Brazil, and Mexico to South Korea.