Skift Take

For Air France, Paris 2024 is a marathon rather than a sprint. A one-off ‘hosting hit’ of â¬160 million should be comfortably absorbed by longer term benefits for the brand.

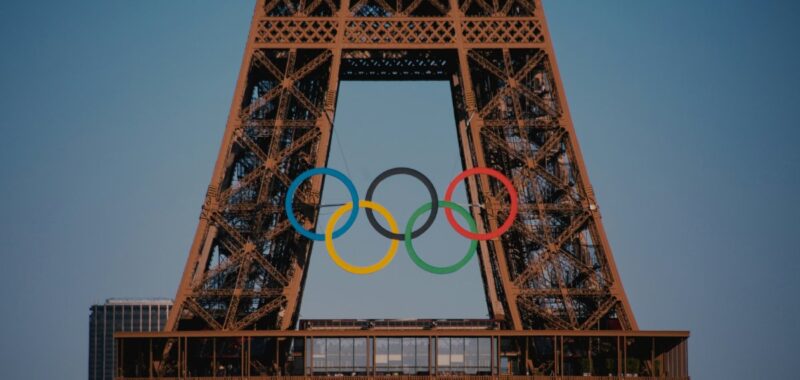

Air France insists it is playing the long game after a costly Olympic Games. The French flag carrier – part of the Air France-KLM Group – posted its third-quarter earnings Thursday and quantified the negative financial impact from the Paris event.

The Olympics cost the firm â¬160 million ($173 million), weighing heavily on its operating income for the all-important June-September quarter. A bonus pot of around â¬50 million ($54 million) to Air France staff ârewarding strong operational performanceâ during the Games was a significant one-off cost.Â

Net profit at AF-KLM was down 13% year-on-year to â¬824 million ($891 million), with Group CEO, Ben Smith, acknowledging that earnings were âsignificantly affectedâ by the event.Â

Large events like the Olympics can be disruptive rather than profitable for airlines. This is particularly true for carriers such as Air France, which have no trouble filling planes in midsummer.

An initial surge of inbound traffic is typically countered by sluggish demand for flights departing the city. The opposite is often true towards the end of the event. These irregular passenger flows are a drag on traditional peak season profitability.

Lucrative business travelers may also postpone non-essential visits until after the competition to dodge the crowds and inflated prices. In a market filing, AF-KLM noted âless international inbound traffic to Paris and less travel from France as a consequence of the Olympic Games.â

Given Air Franceâs âofficial partnerâ status at Paris 2024, the hit could feel counter-intuitive.Â

On Thursday, Smith reiterated that the investment and opportunity cost will pay dividends. âBeyond their financial implications, the Olympic Games provided a unique platform to demonstrate the Groupâs operational expertise and capabilities while offering unparalleled visibility for France as a destination. In the long term, this will be advantageous for the Group,â said the CEO.

Smithâs assessment mirrors that of Paris tourism chief Corinne Menegaux. Speaking to Skift ahead of the Games, she insisted that the Olympics would be a strategic global tourism advertisement for the city, rather than an immediate driver of international visitors. Menegaux highlighted that only 30% of Olympic visitors to Paris were expected to be from overseas.

In the weeks leading to the Games, Air France estimated it would carry 15% of Olympic athletes, 35% of Paralympic athletes and 13% of the members of the broader “Olympic family.”

A Strategic Win for Air France?

Wider benefits should also benefit Air France in the medium and long term. The Olympics brought major infrastructure improvements to Paris, such as upgrades to the cityâs Orly Airport and enhancements to Air Franceâs busy Charles de Gaulle hub. Â

Air France-KLM carried 27.9 million passengers in the third quarter, a 3.5% increase over the same period in 2023. With capacity up by 3.6% and traffic rising by 3.1%, the airline’s load factor – the percentage of available seats that are sold – remained steady at 89%.

AF-KLM is not alone in taking an Olympic hit this summer. Delta Air Lines – its main U.S. partner – also reported weakness in bookings to the French capital during the tournament.

However, taking the full third quarter into account, Delta reported positive trans-Atlantic revenue growth, with traffic to Paris rebounding soon after the competition ended. The Atlanta-based firm previously forecast a $100 million hit because of the Games.

Delta recently signed a new eight-year partnership with the United States Olympic and Paralympic Committee. This covers the 2028 Games, which are due to take place in Los Angeles.

Air France was the second of Europe’s airline “supergroups” to report third-quarter earnings. Lufthansa published a mixed set of figures in late October, while IAG posts its numbers on November 9.

Watch Ben Smith on the Skift Travel Podcast Here:

Airlines Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of airline sector stocks within the ST200. The index includes companies publicly traded across global markets including network carriers, low-cost carriers, and other related companies.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more airlines sector financial performance.

Read the full methodology behind the Skift Travel 200.