The big three online travel agencies in short-term rentals — Airbnb, Booking.com and Expedia/Vrbo — wielded a commanding 71% of global market share in 2024, a huge leap since the pre-Covid era.

Skift Research estimates that the global short-term rental revenue was $183 billion in 2024. That number excludes camping groups, RV and trailer parks.

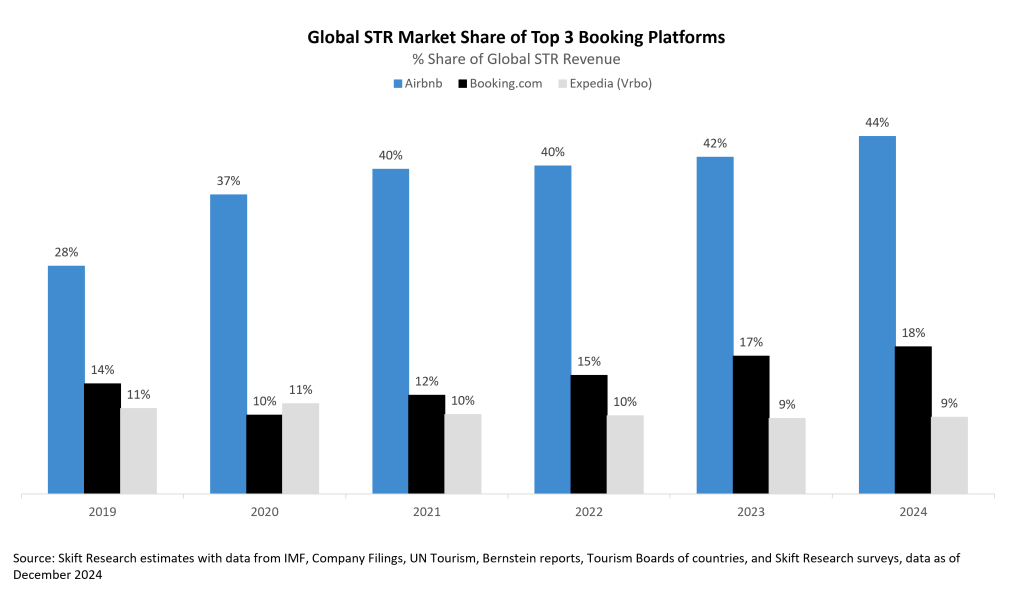

In 2019, prior to the pandemic, Airbnb, Booking.com and Expedia/Vrbo collectively accounted for just 53% of global short-term rental revenue, according to Skift Research. [See the chart below.]

Takeaways 2019-2024

- In that period, Airbnb was the largest mover, increasing its global share of short-term rental revenue from 28% in 2019 to 44% in 2024.

- Booking.com, which has been focusing on growing its alternative accommodation listings, saw its share grow from 14% to 18% in the 2019-2024 period while Expedia/Vrbo’s shrank from 11% to 9%. Much of Vrbo’s drop came from a tech re-platforming and a softening of marketing because of that disruption in the 2022-2023 span.

- The long-tail of smaller online travel agencies, including everyone from Despegar to Awaze and Vacasa, local or regional property managers, and individual owners, saw their share of global short-term rental revenue shrink from 47% in 2019 to 29% in 2024. The long-tail’s 29% share is still substantial; it’s larger than Booking.com and Expedia/Vrbo’s combined share of 27%.

Takeaways From Post-Covid 2022-2024

- When looking at the post-Covid period 2022-2024, Booking.com increased its global market share of revenue fastest among the big three, although from a lower base than Airbnb. Booking.com saw its share grow from 15% in 2022 to 18% in 2024, a 20% jump. At the same time, Airbnb’s global share of revenue jumped from 40% in 2019 to 44% in 2024, which was a 10% leap.

- During the same period, 2022-2024, Vrbo’s share declined from 10% to 9%.

- The long-tail of short-term rental providers — those other than the big three — have taken a severe hit since 2022, seeing their share of global short-term revenue decline from 35% in 2022 to 29% in 2024.

Expansion Ambitions

Don’t expect Airbnb, Booking.com, and Expedia/Vrbo to ease up on their expansion.

Airbnb is sacrificing some profits by seeking growth beyond its handful of core markets, and with a focus on winning over traditional hotel users.

Booking.com reported that its alternative accommodations bookings grew from 25% of its total bookings pre-pandemic to 36% in 2024, and the Amsterdam-based brand is putting a lot of resources into U.S. expansion.

After losing some ground since 2022, and with its re-platforming now behind it, Expedia/Vrbo is seeking to expand its supply and get more efficient in its marketing efforts. Meanwhile, Expedia.com — and not just sister brand Vrbo — is getting more heavily involved in selling vacation rental stays.