Through a rollercoaster few months, as the new Trump administration has enacted—and then often swiftly withdrawn—harsh tariffs on countries around the world, the question of how housing markets will react is a murky one.

While in the long term most experts agree that these new taxes will weigh on homebuilding, it is less clear how housing markets are responding in the near-term to a whipsaw stock market and growing economic anxiety.

According to RISMedia’s latest Broker Confidence Index (BCI) survey (conducted in late April), the decisions of buyers and sellers right now are being affected by the current economic turmoil—though to what degree is not fully clear.

“(There is) consumer unease about what is going to happen in the near future with the tariff wars and their impact on job security and the cost of money,” said Darren Kittleson, principal broker for multiple Keller Williams’ franchises in Wisconsin.

Almost half (45%) of brokers surveyed said in their region, buyers and sellers are altering decisions in the market based on tariffs, inflation, the stock market or other economic factors. A little more than a quarter (27%) of brokers said people in the market were not making housing decisions based on the current turmoil, while 29% said they are not sure if buyers and sellers are affected by the current uncertainty.

One broker, who asked to remain anonymous, reported that “buyers (are) backing off new home construction if there are no caps on building materials in builders’ contracts,” a direct and immediate consequence of tariffs.

While many proposed tariffs are currently paused, economists previously warned that the back-and-forth will still cause consumers to cut back on spending, and force businesses into difficult decisions. At the same time, the latest data on jobs this month showed a (mostly) resilient labor market, buoying hopes that the economy can weather some of the near-term shock.

Looking at real estate specifically, overall broker confidence fell sharply, from 7.0 to 6.1, as brokers appear wary due a lethargic spring market. That represents the second-largest single month drop in the history of the BCI, and comes when brokers historically have felt more optimistic.

Respondents were divided over whether these issues were due to long-running struggles with affordability and inventory, or recent changes in federal policy.

Respondents were divided over whether these issues were due to long-running struggles with affordability and inventory, or recent changes in federal policy.

Raegen Trimmer, broker/owner of RE/MAX Preferred in Wisconsin, described a market dynamic similar to what many regions have struggled with over the past two or three years (or longer).

“We’re seeing strong activity in our market, with many buyers reentering. However, inventory is still tight and listings are getting multiple offers, driving prices up and further pricing buyers out of homes,” she said.

One broker who requested anonymity also cited lack of inventory, saying “there are plenty of people looking to buy and sell” in their market, while expressing the same frustration that the inventory doesn’t “meet the demand.”

Tax and spend

As brokers sort through their own concerns, there is little indication that the Trump administration will chart a more predictable path going forward. That means consumers are likely to face more whiplash from federal policy.

At the highest level, this kind of uncertainty is likely to make people hesitant about big decisions like housing—but what metrics or indicators specifically are most likely to cause buyers and sellers to duck out of the market? Are consumers really paying that close attention to these policies?

The answer to the second question is yes, according to the BCI survey. Asked to identify what storylines or economic issues (local or national) consumers were following most closely, 56% of brokers mentioned tariffs, while 23% pointed to other big-picture economic shifts like inflation, rates or the stock market.

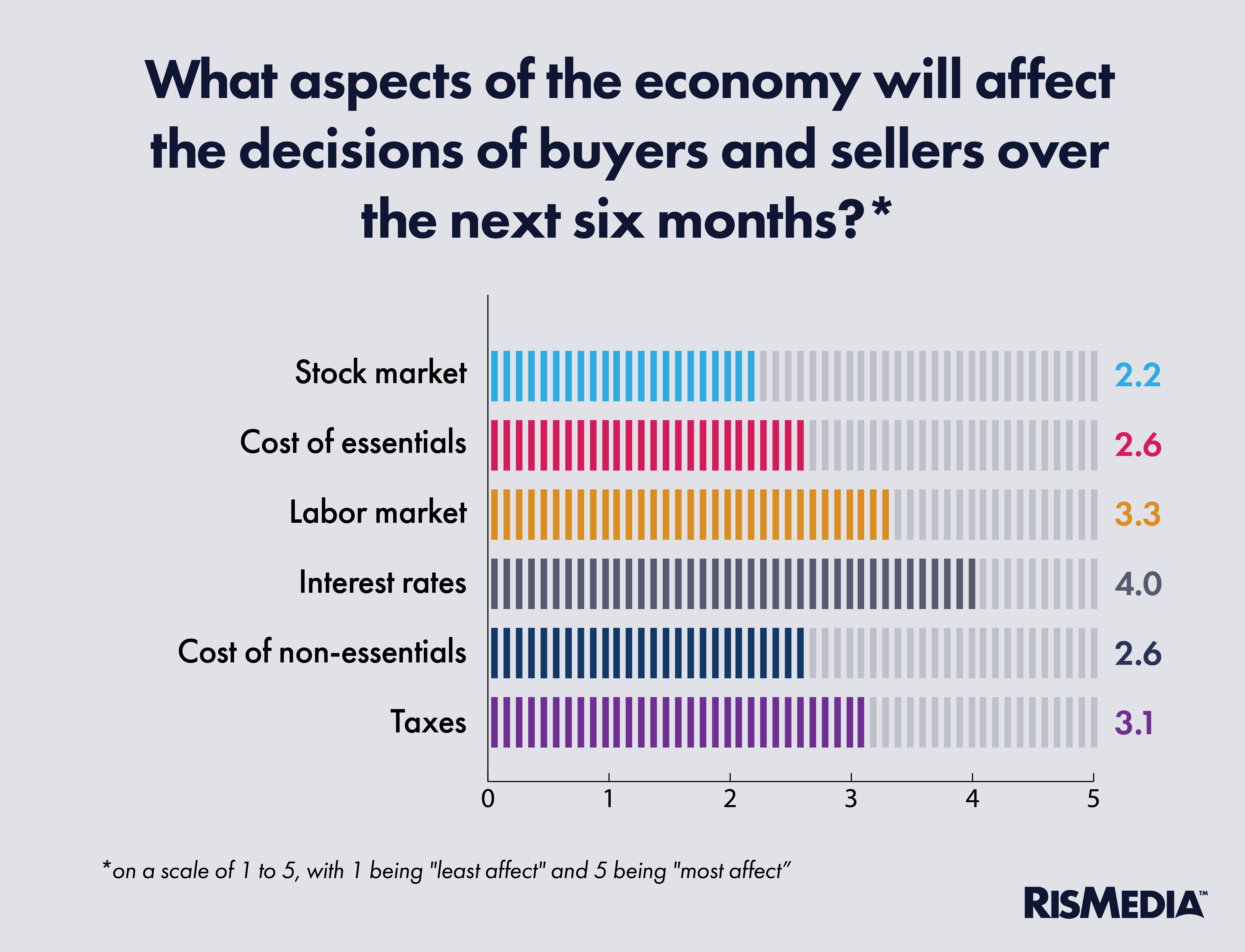

Asked to identify which of these are most likely to affect the buying or selling decisions of people in their markets, brokers pointed to rates (both mortgage and otherwise) as well as jobs and taxes as most likely to cause someone to adjust their real estate plans.

Notably, while up-and-down stock indices have received overwhelming media attention, brokers said those shifts were least likely to drive housing decisions in their regions. On the other hand (and perhaps unsurprisingly), job markets were seen as very much affecting people’s choices to transact, with more than a quarter (27%) of brokers saying the job market had the largest effect on buyers and sellers.

Notably, while up-and-down stock indices have received overwhelming media attention, brokers said those shifts were least likely to drive housing decisions in their regions. On the other hand (and perhaps unsurprisingly), job markets were seen as very much affecting people’s choices to transact, with more than a quarter (27%) of brokers saying the job market had the largest effect on buyers and sellers.

“Housing affordability is a major concern, along with rising grocery prices and the overall cost of living,” said Trimmer. “There’s a lot of talk around how new tariffs are hitting local farmers.”

While the fact that companies are continuing to hire is obviously a positive, economists largely expect a pullback in at least some sectors based on the tariffs—though again, uncertainty remains and federal policy could quickly shift again.

Jim Fite, president and CEO of CENTURY 21 Judge Fite Company in Texas and Oklahoma, said that consumers are following tariffs based on their potential to affect inflation, and the “short-term outlook” for savings and investments.

On the other hand, some brokers said that local issues continue to be top of mind among buyers and sellers. Trimmer said that along with tariffs, consumers are closely watching the state budget and taxes, and are also concerned with “political tension” both in their communities and across the country.

One Indiana broker, who requested anonymity, pointed to a bill passed in his state meant to reduce property taxes. The broker claims that “trying to figure out how this confusing legislation will impact property taxes is a problem,” and that taxes are actually going up—obviously having a more direct impact on buyers and sellers compared to federal trade policy.