Election Day is here, and while many real estate professionals are likely very attuned to the outcome of national races, it probably isn’t because they’re counting on the federal government to make big changes that affect their business. As almost everyone who has spent time in real estate recognizes, it’s a local industry, and county, town and state governments have an exponentially larger effect on housing than federal policies.

But that doesn’t mean the process or outcome of a presidential election is irrelevant to real estate. Brokers polled in RISMedia’s Broker Confidence Index (BCI) last month made it clear that they see shifts coming out of this particularly unique and acrimonious campaign, and were also watching for candidates to speak at least qualitatively to the issues they felt were important to the industry.

Additionally, the BCI saw a significant overall drop from last month, from 7.2 to 6.2, in defiance of generally positive national data from pending home sales. While mortgage rates, which boomeranged higher by 64 basis points last month, are at least partially to blame, it is also possible that brokers are feeling a little bit of election anxiety themselves, with around 30% mentioning the election as something that was weighing on their confidence.

One broker, who requested anonymity, said they were most worried about consumer confidence “if our country is consumed with chaos,” along with the “economic consequences of federal policies.” Others mentioned buyer “apathy” leading up to the vote, or policies only tangentially connected to the election like the Federal Reserve’s rate-cutting plans.

Regardless of the outcome, nearly all brokers saw the election as affecting something related to the real estate business. Interestingly, rates were the policy issue brokers saw as most likely to be affected by the presidential election, with 34% saying they expected a significant shift based on the outcome in the next year or so.

Fed Chair Jerome Powell was nominated by former president Donald Trump, a Republican, but then renominated for a second term by current president Joe Biden, a Democrat. His current term ends in 2026. Trump has said he would replace Powell at the end of his term, and was critical of him during his presidency. He has also said he wants to personally intervene in the historically independent central bank’s decision-making, something Vice President Kamala Harris vowed she would not do.

Notably, Harris voted against Powell’s appointment in 2018 when she was a U.S. Senator, although she hasn’t commented publicly on replacing him.

The other area brokers saw as most likely to be influenced by the election is lawsuits and investigations into the industry, with 45% viewing the outcome as influential in that regard as legal issues continue to loom.

It was under Trump that the Department of Justice (DOJ) opened its most recent antitrust probe into the National Association of REALTORS® (NAR), although his administration appeared ready to accept a handful of policy changes and was ready to end the inquiry back in 2020.

Months later, though, Biden’s DOJ reneged on the deal, setting off a court battle that spanned most of the last three years over whether the DOJ should be allowed to reopen the investigation into Clear Cooperation and other NAR policies. A Trump-appointed federal judge on a panel overseeing that case speculated last year that NAR had essentially gambled on Trump winning the 2020 election when it negotiated with the DOJ, expecting the investigation would stay closed if “personnel in the antitrust division didn’t change.”

The DOJ under Biden has also been actively intervening in other real estate antitrust cases, from commission class-actions to lawsuits by listing startups. It is unclear if a Harris administration would deviate from this policy, though she did explicitly say she would seek to end alleged price-fixing by landlords, something championed under Biden.

Other policy issues that brokers saw as hinging on the election outcome were housing affordability and home prices, with 23% of brokers citing these. As previously covered by RISMedia, the Trump campaign has tried to pin housing costs on immigration, despite experts finding little evidence for those claims, while Harris has promised specifically to build 3 million more homes and provide $25,000 in down payment assistance to certain homebuyers. Critics of that plan have said this would ultimately cause housing prices to increase.

Transition of power

Looking specifically at the candidates, more brokers saw Trump—who has a background in real estate investment and development—as having spoken to issues that affect the industry during his campaign. A little under half (44%) said Trump had adequately addressed these issues, compared to only 22% who said the same about Harris.

Just under a third (31%) said neither candidate had spoken adequately to these issues.

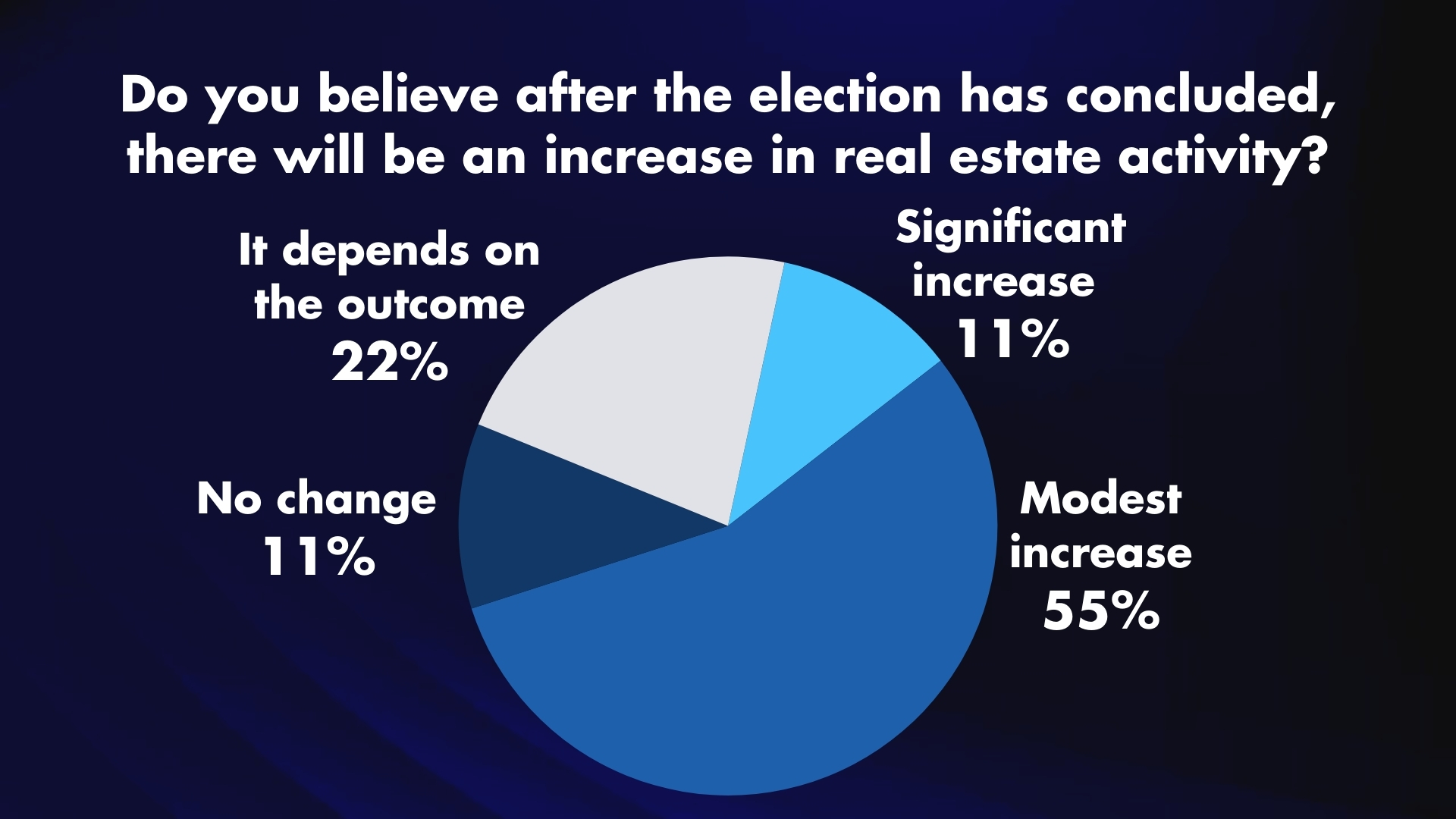

But a clear majority expected that an end to the campaigns and a final election outcome would be good for real estate. Two-thirds (66%) said that they anticipated an increase in real estate activity after the election regardless of who wins, compared to only 11% who said they expected no change. Around a quarter (22%) said that their expectations hinged on the outcome.

Brokers generally expected the election outcome to have an effect on consumers more than on the industry directly. Consumer behavior was the No. 1 choice for brokers when asked what would most be affected by the election, with 65% viewing consumers as changing their decision-making based on who is in office next year.

Brokers generally expected the election outcome to have an effect on consumers more than on the industry directly. Consumer behavior was the No. 1 choice for brokers when asked what would most be affected by the election, with 65% viewing consumers as changing their decision-making based on who is in office next year.