Between the start of 2023 and the midpoint of 2024, the bulls were firmly in control on Wall Street. The rise of artificial intelligence (AI), the return of stock-split euphoria, and better-than-expected corporate earnings/economic data helped propel all three major stock indexes to multiple record-closing highs.

But as history has repeatedly shown, the stock market doesn’t move up in a straight line. Recently, the growth-focused Nasdaq Composite entered correction territory, with the index shedding nearly 1,400 points, or roughly 8% of its value, during the first three trading days of August.

The ingredients for a stock market crash or bear market decline do exist — and crashes have historically represented an excellent opportunity for long-term investors to open positions or increase their existing stakes in high-quality businesses.

Though there are a number of stocks on my buy radar if the broader market sell-off accelerates, the one I’m particularly eager to triple my existing stake in is a virtually unknown company that’s doling out a market-crushing 11% yield.

The ingredients for a stock market crash are in place

Let me open this discussion by pointing out that no economic data point, metric, or forecasting tool can, with 100% accuracy, predict the short-term future. Nevertheless, there are certain metrics and events that have strongly correlated with significant moves higher or lower in the broader market throughout history — and I’m a big fan of history rhyming on Wall Street.

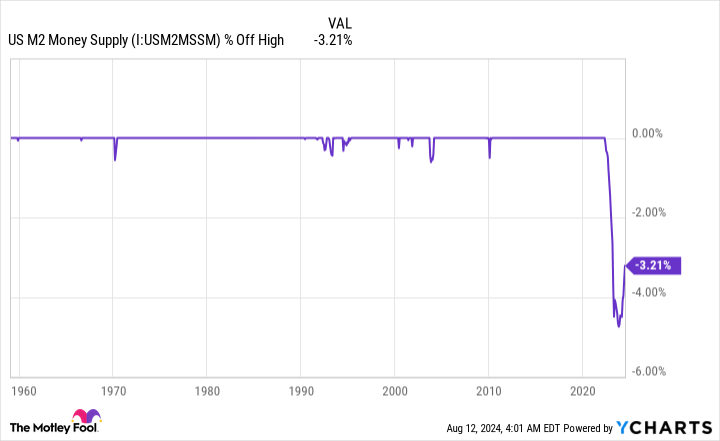

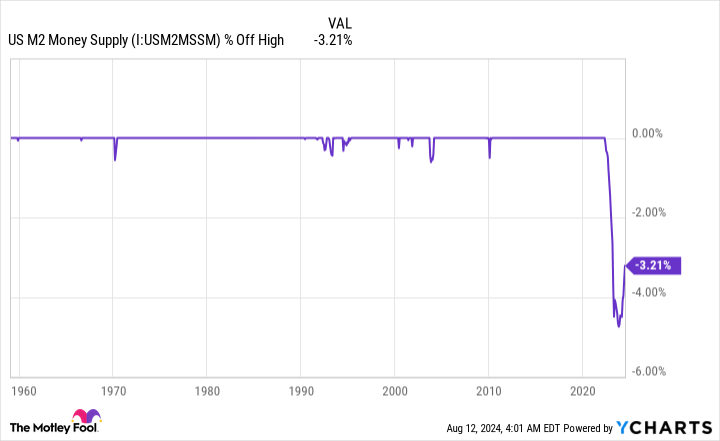

As an example, we’ve witnessed the first meaningful decline in U.S. M2 money supply since the Great Depression over the last two years. M2 money supply factors in everything in M1 (cash and coins in circulation, along with demand deposits in a checking account), and adds in savings accounts, money market accounts, and certificates of deposit (CDs) below $100,000.

Most economists pay little attention to money supply because it’s risen with such consistency for 90 years. This is to say that an expanding economy has needed more capital to facilitate transactions. However, there’s been a greater than 3% decline in M2 since it peaked in April 2022.

Last year marked only the fifth time in 153 years that M2 declined by at least 2% on a year-over-year basis. The previous four instances, which occurred between 1878 and 1933, coincided with periods of economic depression and double-digit unemployment rates. While a depression is highly unlikely today, a decline in discretionary spending, spurred by a reduction in M2, suggests a recession is on the horizon.

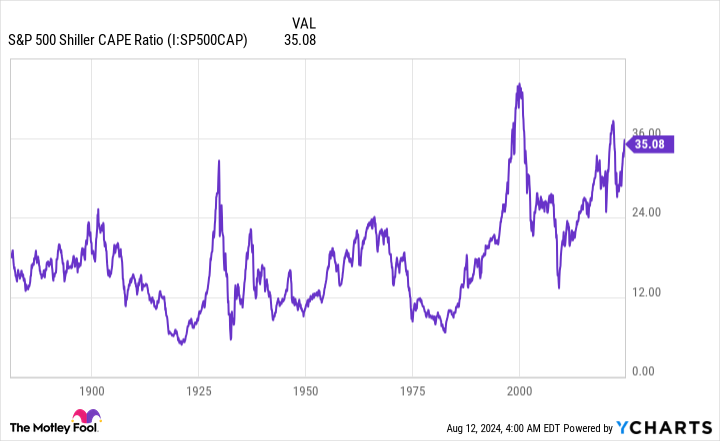

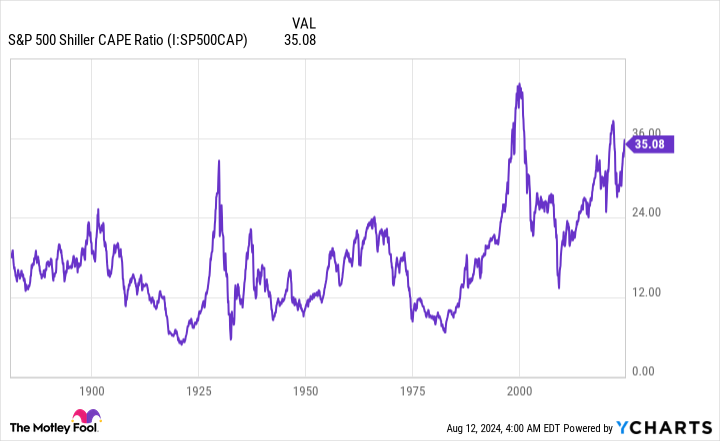

Additionally, the S&P 500’s Shiller price-to-earnings (P/E) ratio points to stocks being historically pricey. The Shiller P/E is also commonly referred to as the cyclically adjusted price-to-earnings ratio, or CAPE ratio.

The Shiller P/E, which is based on average inflation-adjusted earnings from the previous 10 years, ended Aug. 9 at 34.47, or roughly double its average reading of 17.14, dating back to January 1871.

But the more worrying aspect of the S&P 500’s Shiller P/E is how the broader market has reacted following instances where it’s surpassed 30. This has only occurred on six occasions dating back 153 years. Following the prior five instances, Wall Street’s major stock indexes shed between 20% and 89% of their value. Put another way, premium valuations aren’t tolerated over long periods by investors.

M2 money supply, the Shiller P/E, and other predictive indicators strongly suggest a bear market or outright crash may be forthcoming.

This under-the-radar 11%-yielding stock makes for a phenomenal buy during periods of panic

Should the stock market tumble, the virtually unknown ultra-high-yielding stock I’m looking to triple my position in is business development company (BDC) PennantPark Floating Rate Capital (NYSE: PFLT).

A BDC is a company that invests in the debt or equity (common and/or preferred stock) of middle-market businesses — i.e., generally unproven small- and micro-cap companies. Although PennantPark held nearly $209 million in various preferred stock and common equity positions as of June 30, its $1.45 billion in first-lien secured debt makes it a primarily debt-focused BDC.

The advantage of focusing on debt has everything to do with yield. Since most middle-market businesses have limited access to traditional financial services, PennantPark is usually able to generate yields on loans that are well above the market average. As of the midpoint of 2024, it was hauling in a 12.1% weighted average yield on debt investments.

More importantly, PennantPark Floating Capital’s entire debt-securities portfolio is variable rate. The most aggressive rate-hiking cycle in four decades has helped increase PennantPark’s weighted average yield on debt investments by 470 basis points since Sept. 30, 2021. Even with the nation’s central bank widely expected to kick off a rate-easing cycle next month, the company’s weighted average yield on debt investments will remain many multiples above the prevailing inflation rate.

The biggest concern with a small-cap BDC focusing its lending efforts on generally unproven businesses is how well these borrowers are going to fare if the U.S. economy weakens. Thankfully, PennantPark’s management team has taken a number of steps to properly vet its loans and protect its principal.

For example, the company’s $1.66 billion investment portfolio, which includes equity investments, is spread across 151 companies. With an average investment size of “only” $11 million, no single debt or equity deal is critical to the company’s success.

What’s more, all but $1.2 million of PennantPark’s $1.449 billion debt securities portfolio is of the first-lien secured variety. In the unlikely event that one of the company’s borrowers seeks bankruptcy protection, first-lien secured debtholders are at the front of the line for repayment.

The steps PennantPark has taken to properly vet middle-market companies and protect its principal resulted in a reasonably low non-accrual (delinquency) rate of 1.5% of the portfolio’s cost basis as of June 30.

The company’s valuation is the final puzzle piece that would entice me to triple my existing stake. As of the closing bell on Aug. 9, shares were trading 4.4% below its generally accepted account principles (GAAP) net asset value (NAV) per share of $11.34. It’s not uncommon for short-lived, emotion-driven panic selling during bear markets and stock market crashes to briefly push companies like PennantPark well below their NAV. Most of the time, the share price of BDCs hovers very close to their NAV.

PennantPark Floating Rate Capital shouldn’t have any trouble sustaining its monthly (yes, monthly!) payout of $0.1025 per share, which currently equates to an 11.4% annual yield.

With dry powder at the ready, I’d welcome the opportunity to triple my position in this under-the-radar income powerhouse.

Should you invest $1,000 in PennantPark Floating Rate Capital right now?

Before you buy stock in PennantPark Floating Rate Capital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PennantPark Floating Rate Capital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Sean Williams has positions in PennantPark Floating Rate Capital. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Meet the Virtually Unknown 11%-Yielding Dividend Stock I Want to Triple My Stake in if the Stock Market Crashes was originally published by The Motley Fool