Around two-thirds of U.S. housing units are occupied by their owners. That leaves millions of Americans living in homes they rent rather than own. Folks rent for many reasons. Rising interest rates, crushing mortgage rates and spiking home values have shut some interested homebuyers out of the market, forcing them to rent. Others rent because they prefer the flexibility and decreased responsibility.

For example, most of Gen Z now say renting is better than owning a home.

Check Out: Dave Ramsey’s Best Passive Income Ideas for 2024 — 15 ‘Steady, Profitable’ Ways To Build Wealth Fast

Read Next: Become a Real Estate Investor for Just $1K Using This Bezos-Backed Startup

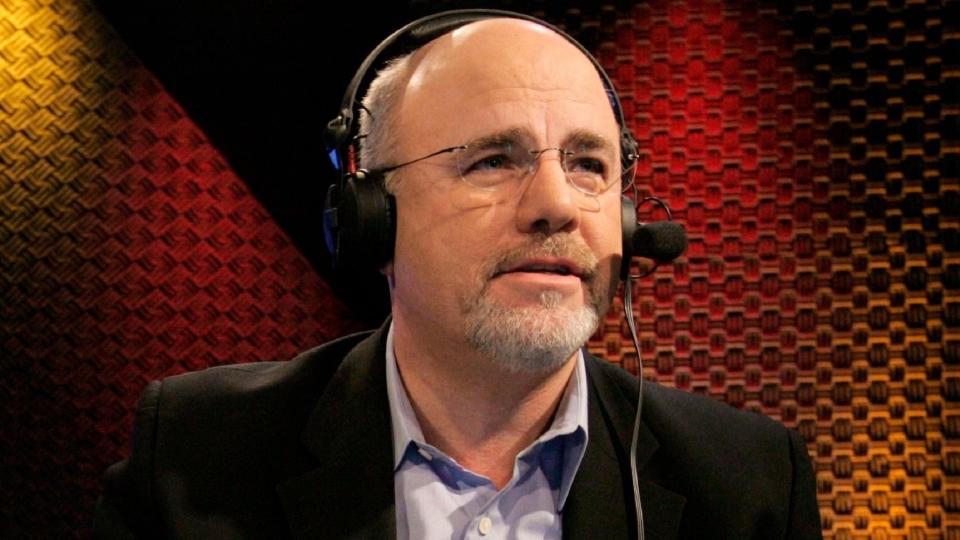

Personal finance author and radio personality Dave Ramsey disagrees. In a recent YouTube video, he outlined why owning a home is ideal, even if you like renting. Here’s why Ramsey believes you should aim to own your home.

Earning passive income doesn’t need to be difficult. You can start this week.

Is It OK To Rent Your Home Forever?

Ramsey’s video started with a question from a listener about whether it’s OK to rent your home forever. She said she rents her apartment in a great city and is very happy with it. She’s close to work, church and social activities. To buy a home she could afford, she’d have to move way outside her current city.

In this scenario, renting seems logical. Many other people may find themselves in similar situations where they’re happy renting. But even so, Ramsey argued that owning a home is preferable — at least sometime before retirement.

Trending Now:

Ramsey acknowledged that renting is sometimes reasonable, depending on your needs and preferences: “I can completely endorse that where you are today in your life, this particular situation makes sense. It sounds like you got it made right now.”

The caveat is that Ramsey doesn’t think renting works over the long term compared to homeownership. He noted that rental rates increase nearly every year. Between 2019 and 2023, rents increased more than 30% on average in the U.S. Rent increases are now slowing in many places, but Ramsey’s point about rising rental prices stands.

Renting in Retirement

As you look toward retirement, it’s better to have an asset that can grow in value — a home you own — than a rental expense that just keeps creeping higher.

Retirees often live on a fixed income, relying on Social Security payments, savings or pensions. You’ll likely have minimal housing costs if you own your home outright in retirement. Even if you still owe money on your mortgage, your housing expenses should be predictable and manageable.

However, for renters in retirement, increasing rental rates can quickly become a drain on their fixed income. Ramsey said housing is the “most expensive line item in your budget.” If your housing expenses are “out of your control, variable and increasing,” as rental prices usually are, “that’s not sustainable long term.”

Comparing Homeownership and Renting

Statistics about homeowners’ finances compared to renters’ support Ramsey’s pro-homeownership stance.

According to the Federal Reserve, the median net worth for homeowners in the U.S. was $396,200 in 2022. By comparison, renters had a median net worth of just $10,400. That suggests homeowners are nearly 40 times wealthier than renters.

Renters are also much more likely to rate their financial situation poorly compared to the average American. Part of the issue is that inflation hits renters harder than homeowners.

If you own a home with a fixed-rate mortgage, your monthly payments don’t change even during periods of high inflation. On the other hand, renters face rising rent prices that may outpace the average inflation rate.

When home values go up — as they have dramatically since 2020 — homeowners grow their net worth, while renters must cover higher expenses. Over time, homeowners come out far ahead of renters, at least financially.

Saving To Buy a Home

If you’re currently renting and can’t see a feasible path to homeownership, you’re not alone. More than half the renters in the U.S. who want to own a home don’t think they’ll ever be able to afford one.

To get closer to owning your home, you need to start saving, even just a little at a time. You’ll need to put some money down on the home, though the percentage varies. In 2023, first-time homebuyers typically put down 8% of the purchase price, compared to 19% for repeat buyers.

Work on paying off any outstanding debt, like credit card balances and student loans, to free up some funds and improve your debt-to-income ratio. Then create a budget that works.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey: Why You Shouldn’t Rent Long Term Even if You Don’t Want To Own