As global markets continue to navigate a landscape marked by mixed economic signals and varied regional performance, investors are closely monitoring shifts in market dynamics and corporate earnings. In this context, growth companies with high insider ownership can be particularly intriguing, as significant insider stakes often signal confidence in the company’s future prospects amidst such uncertain conditions.

Top 10 Growth Companies With High Insider Ownership

|

Name |

Insider Ownership |

Earnings Growth |

|

Yggdrazil Group (SET:YGG) |

12% |

33.5% |

|

Kirloskar Pneumatic (BSE:505283) |

30.6% |

30.1% |

|

Archean Chemical Industries (NSEI:ACI) |

22.9% |

28.9% |

|

Gaming Innovation Group (OB:GIG) |

26.7% |

37.4% |

|

Medley (TSE:4480) |

34% |

28.7% |

|

Rajratan Global Wire (BSE:517522) |

19.8% |

33.5% |

|

Fine M-TecLTD (KOSDAQ:A441270) |

17.1% |

36.4% |

|

Credo Technology Group Holding (NasdaqGS:CRDO) |

14.4% |

60.9% |

|

Vow (OB:VOW) |

31.7% |

97.7% |

|

EHang Holdings (NasdaqGM:EH) |

32.8% |

74.3% |

Click here to see the full list of 1461 stocks from our Fast Growing Companies With High Insider Ownership screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: KinhBac City Development Holding Corporation, a real estate company based in Vietnam, has a market capitalization of approximately ₫21.42 billion.

Operations: The primary revenue segment for the firm is trading in real estate, generating approximately ₫3.55 billion.

Insider Ownership: 19.9%

KinhBac City Development Holding, despite a challenging quarter with significant losses and reduced revenue, is poised for robust growth. Analysts predict its earnings to grow by 42.51% annually, outpacing the Vietnamese market’s 19.5%. Revenue forecasts are also strong at 39.1% yearly growth, exceeding market expectations of 16.9%. However, recent performance shows a downturn with profit margins dropping from last year’s higher levels. The stock is currently undervalued according to analysts, suggesting potential upside despite recent operational challenges.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dohome Public Company Limited operates in Thailand, specializing in the retail and wholesale of construction materials, office equipment, and household products, with a market capitalization of approximately THB 36.49 billion.

Operations: The company generates revenue primarily through the retail and wholesale of construction materials, office equipment, and household appliances, totaling approximately THB 30.73 billion.

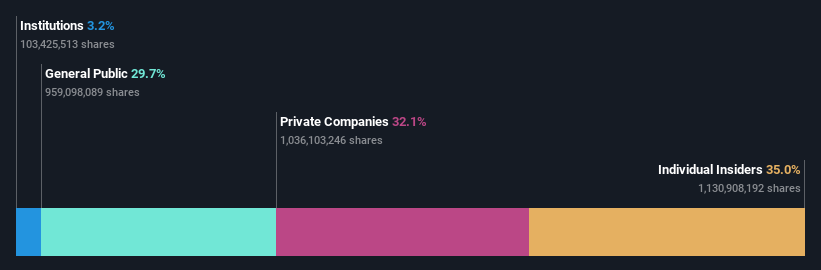

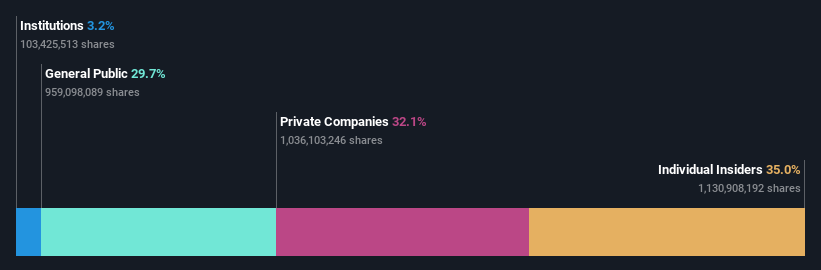

Insider Ownership: 35%

Dohome Public Company Limited recently reported a slight decline in quarterly earnings and revenue, with sales dropping to THB 7.88 billion from THB 8.38 billion year-over-year. Despite this, the company is expected to outperform the Thai market with its annual earnings growth projected at a significant 32.8% and revenue growth at 9.5%. However, its return on equity is forecasted to remain low at 9.5% in three years, indicating potential challenges in generating shareholder value relative to its capital base.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: King Slide Works Co., Ltd. specializes in the R&D, design, and sale of rail kits for servers and network communication equipment in Taiwan, with a market capitalization of NT$109.12 billion.

Operations: The company generates revenue primarily through Chuan Yi Company at NT$5.02 billion and Chuanhu Company at NT$1.82 billion.

Insider Ownership: 17.5%

King Slide Works Co., Ltd. is experiencing steady growth, with earnings projected to increase by 14.76% annually and revenue forecasted to grow at 23.3% per year, outpacing the TW market’s average. Despite these positive trends, its earnings growth lags behind the broader market’s expected 18.8%. Recent executive changes signal a refreshed leadership structure, potentially impacting future strategies and operations. The company also maintains a high level of non-cash earnings, suggesting quality in reported profits.

Where To Now?

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include HOSE:KBC SET:DOHOME and TWSE:2059.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com